What is real estate syndication?

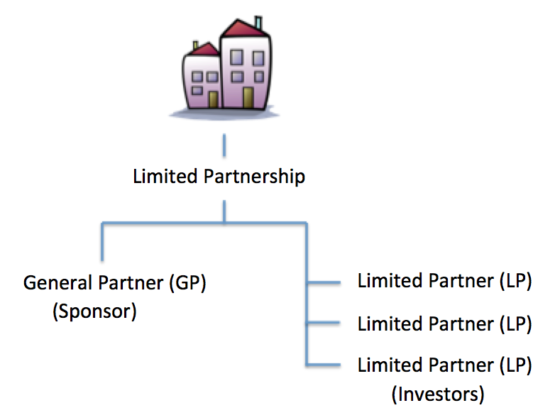

A real estate syndication is when one or more people or entities pool capital together to purchase an asset, in this case the asset is real estate. The individuals investing in the real estate syndicate do not have voting rights, therefore they are passive real estate investors.

A real estate syndicate uses the pooled capital to buy one or multiple properties. The passive investors own part of a company that owns actual brick and mortar real estate. These properties produce tax benefits, and if managed properly, positive cash flow and wealth over time.

How does a Joint Venture Differ?

Real estate syndications are different from a Joint Venture in that investors in Joint Ventures, or JVs, often have voting rights and day to day responsibilities.

One of the largest advantages of a real estate syndication or a real estate investment trust (REIT) is that the investors are completely passive, allowing them to have no day to day responsibilities in the property management.

RE is a very management intensive asset, meaning many new landlords find themselves surprised at how much work is involved in owning and managing their properties, especially commercial real estate. The investment becomes more of a burden overtime often prompting new real estate investors to sell their current properties (hopefully for a profit) and invest passively in a real estate syndication or a REIT.

What are the Risks?

A confidential private offering memorandum and/or a private placement memorandum will outline the risks of the investment and strategies of the management team.

Generally, the risk is limited to your investment amount meaning you should not be on the hook to owe additional funds to the bank in the event of foreclosure.

What are the Benefits?

- Less volatile

- Tax depreciation

- Not correlated with the stock market

- Brick and mortar RE ownership

- Generally larger equity growth over time

What are the Negatives?

- Long term investment

- Generally less cash flow

- Investment in one market

What is REIT?

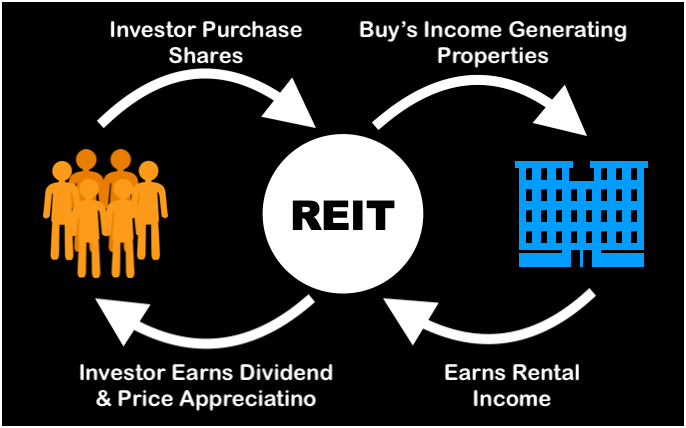

Real estate investment trusts or a REIT is a company that owns, finances and manages income producing RE, generally commercial real estate, where the investors own shares, or stock in the company. This allows the investors to earn dividends from the stock and easily move in and out of the investment.

What Type of Real Estate does a Real Estate Investment Trust Own?

REIT’s invest in many different types of real estate such as apartment buildings, office buildings, shopping malls or a real estate investment portfolio. Publicly traded REIT’s are not limited to accredited investors.

Mutual funds can hold multiple REIT’s to allow for further diversification. Anyone can own a publicly traded stock where syndicates are required to work with qualified investors only.

What about Tax Deductions?

Tax deductions are not passed through when you invest in a REIT and you will not be locked into a particular investment.A real estate investment can be made more accessible with the affordable trading platforms available today. REITs make real estate investing easy and allows for access to commercial real estate ownership for non-accredited investors.

What are the Benefits?

- Easy to get started

- Small minimum investment

- Strong cash flow through dividends

- Diversification over many markets

What are the Negatives?

- High volatility

- Lesser equity growth historically

- No tax breaks

Let’s explore the biggest differences between REITs and Real Estate Syndication.

When investing in real estate, one should consider how much they need tax benefits. Someone in a higher tax bracket may value tax benefits more than someone in a lower tax bracket.

Tax Depreciation

One of the key benefits of real estate syndications is that the passive investors have direct ownership in the real estate. This creates more tax benefits for the investors not found in a real estate investment trust (REIT).

The investors in a real estate syndicate will likely receive a K-1 tax form at the end of the year allowing them to claim tax depreciation.

Investors in a publicly traded REIT often do not receive the tax depreciation offered through direct ownership of real estate, which is accomplished through investing in real estate syndications.

People are often drawn to real estate investing because of the tax benefits. Commercial real estate and office buildings especially offer consistent of tax depreciation.

Volatility

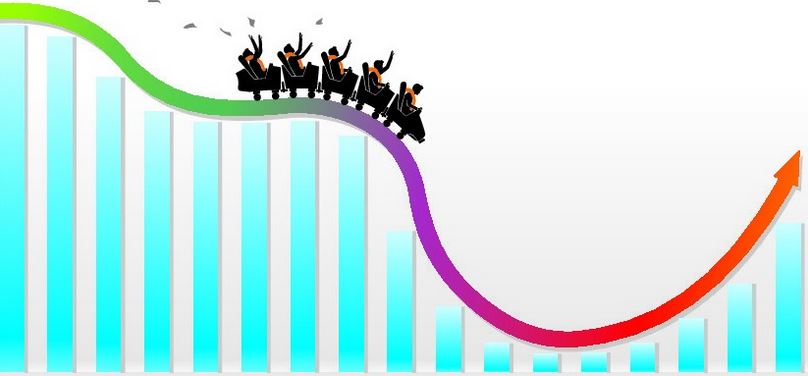

Since a stock can be bought and sold in an instant, REIT’s are a more liquid investment but are also more volatile than real estate syndications. Investment minimums tend to be less with a REIT since a single stock can be bought for perhaps just a few bucks.

Real estate syndications tend to be longer term commitments with no opportunity to exit the investment for three to five years.

Liquidity

REITs are more liquid and allow you to sell your stock in an instant. This is important if you are seeking to move money freely in and out of the market or over a short period of time. By purchasing shares one can invest in real estate and join many investors in the process. The securities act has made this easier than ever.

Liquidity can be a double edge sword as it does allow investors to enter and exit quickly but will cause more volatility. When investors are locked into an investment until a liquidity event such as a sale or refinance of property, this causes more stability in the asset price.

Higher Minimum Investments

The reality is that real estate syndications are only an option for individuals with about $25,000 or more available to invest. If you are not yet there, join other commercial real estate investors using a REIT and build your wealth to one day graduate into real estate syndication investments.

Cash Flow

REITs historically have produced stronger passive income through dividends. Apartment buildings tend to be a smart investment opportunity if managed properly. Cash flow and profits tend to be strongest in invested in an apartment building over a single property. The best asset class to invest directly, and for tax depreciation benefits, tends to be the apartment building.

Diversification

Commercial real estate investing is best accomplished over multiple markets which is more easily accomplished by investing in a REIT. If owning a specific property is exactly what matters to you, then a syndication will interest you more.

Legal Documents

There are often legal documents, disclosures, a business plan and underlying real estate to review when investing in a syndication that will not be required for a REIT.

Which one should I invest in?

Investing in real estate is easier than ever. Passive real estate investing allows beginners to own large scale property that in the past would never be possible. Perhaps develop a basic business plan to help guide your prospective investments.

REIT

Invest in a REIT if you are seeking a lower minimum investment amount. Passive income can be generated, supported by major stock exchanges, and you can diversify your investment over multiple markets and real estate assets.

Syndication

Equity REITs tend to produce stronger gains through dividends where real estate syndications offer direct ownership and better tax breaks. Investment minimums will be larger with real estate syndications so be sure not to invest capital you may need back in the near future.

If you care about your tax bill then a syndication will likely interest you more. Ordinary income earned through a syndication over the same period when investing in a REIT will result in a far smaller tax bill. Many investors prefer tax savings and tax depreciation benefits through their real estate investments.

The Power of Equity Ownership

If invested in high demand markets and properly managed over time, the value of owning real estate equity can not be overlooked. Fortunes are generally earned in real estate through equity growth over time, not short term cash flow.

REITs and real estate syndicates are both viable options for the savvy investor seeking to own real estate assets but the biggest differences between REITs and syndicates is the potential of equity growth. Syndicates allow people to own actual property and this can flourish in value over time.

Also paying yourself through refinance has huge tax benefits over selling a stock or collecting a dividend.

Long Term Mindset

The most successful investors maintain a long term mindset. This means invest for tomorrow not today. Don’t own a single property such as a single family home, own part of a strip of shopping malls.

Invest for cash flow and profits but maintain a tax strategy that puts money in your bank account, not the IRS. When it comes to REITs vs syndicates, the long-term benefits of multifamily syndicates invested in specific property come out ahead.

FAQ

Is a REIT the same as a syndication?

No, a REIT that is publicly traded is a stock backed by RE where a syndication is ownership of a specific property or portfolio of properties.A REIT pays the investor dividends, a syndication produces positive cash flow. Other income can be realized through tax depreciation which is earned in a syndicate.

What is the difference between an equity REIT and a real estate syndicate?

An equity REIT is is more liquid investment, a stock backed by real estate, that tends to produce strong dividends where a real estate syndicate is ownership of actual property and tends to produce stronger equity growth over time.An investor in an RE syndicate will likely purchase shares. Sometimes the tax depreciation benefits surpass the high dividends available through a REIT.

Why REITs are a bad idea?

REITs are a bad idea because they can fluctuate with the volatility of the stack market. When the pandemic hit in 2020, some REITs dropped by 80% in value. Although they have since rebounded, the volatility of the stock market is why many people prefer diversifying to RE.

Having some of your wealth invested in a REIT is not a bad idea but do not mistake that for diversification out of the stock market. True market diversification is accomplished through actual ownership of RE which can be completed using a syndicate.